A Guide to the Park+ App

Introduction:

The Park+ app provides tools for managing various car-related tasks in India. This guide explores the app’s features and functionality.

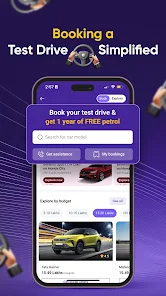

Main Features:

- Parking Discovery and Booking: Park+ allows users to discover and book parking spaces in advance. (Research and add details: How far in advance can users book? What types of parking are available – street parking, garages, etc.? Are there any booking fees?)

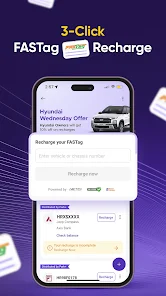

- FASTag Management: Users can purchase new FASTags, recharge existing FASTags from any bank in India, and view transaction history within the app. (Research and add details: How does the recharge process work? Does Park+ integrate directly with all banks or use a third-party service?)

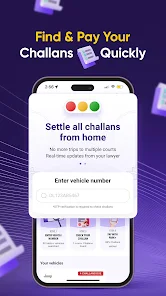

- Vehicle Information: By entering a vehicle registration number, users can access information such as the vehicle owner’s name, make, model, class, insurance details, PUCC status, engine details, fuel type, registration details, and ex-showroom price. (Research and confirm data source: The original text mentions retrieving data from publicly available sources like vahan.parivahan.gov.in. This should be stated explicitly.)

- Car Insurance Management: Users can manage existing car insurance policies, check premiums, renew policies, and access policy documents through the app. (Research and add details: Does Park+ partner with specific insurance providers? Can users compare quotes from different insurers?)

- Selling Your Car: Park+ offers tools to facilitate the sale of used cars. (Research and add details: How does the selling process work? Does Park+ provide valuation tools or connect sellers with buyers directly?)

- Loan and Credit Card Options (India Only): Park+ connects users with potential lenders for personal loans and credit cards. The app facilitates connections with lending partners such as Credit Saison, Niro, L&T Finance, and Hero Fincorp (through Prefr aggregator). (Research and add details: How does the matching process work? What factors are considered? Provide more information about typical interest rates, loan terms, and eligibility criteria. The example loan information should be presented as a hypothetical example and not as a guarantee.)

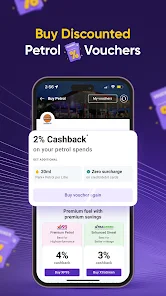

- Fuel Price Information: The app provides information on daily petrol, diesel, and CNG price fluctuations in various cities in India. (Research and add details: Where does this data come from? How frequently is it updated?)

- EMI Calculator: Users can use the built-in EMI calculator to estimate monthly loan payments. (Research and add details: What inputs are required for the calculation – loan amount, interest rate, loan term?)

- Reminders and Alerts: The app provides reminders for important dates, such as insurance renewal, PUCC expiry, and low FASTag balance.

Frequently Asked Questions (FAQs):

-

Q: Is Park+ free to use?

- (Research and provide the correct answer. Example: “The Park+ app is free to download and use. However, some services, such as FASTag recharges or loan applications, may involve transaction fees or charges from partner institutions.”)

-

Q: How do I recharge my FASTag using Park+?

- A: Open the Park+ App > Click on FASTag > Select Recharge > Enter vehicle/Car registration number or chassis number & click Proceed > Enter recharge amount > Proceed to pay.

-

Q: How do I check my FASTag balance?

- A: Open the Park+ App > Click on Add Car > Enter vehicle registration number > Add Vehicle > View Balance

-

Q: Where does Park+ get vehicle information?

- A: Park+ retrieves vehicle information from publicly available data aggregators such as vahan.parivahan.gov.in. Park+ does not represent any Government entity.

-

Q: How does Park+ connect me with lenders?

- (Research and provide the correct answer. Example: “Park+ partners with various lending institutions and acts as a facilitator, connecting users with potential loan and credit card offers based on their provided information.”)

Final Words:

The Park+ app provides tools to manage various aspects of car ownership in India, consolidating multiple functions into a single platform. It is recommended that users review the app’s terms and conditions and conduct their own research before making any financial decisions, such as taking out a loan.